jefferson parish property tax search

Welcome to the Jefferson Parish Assessors office. You can get an appeal filed in two minutes or less with TaxProper and be.

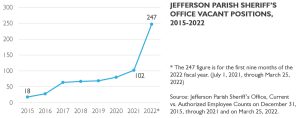

Bgr Analyzes Jefferson Parish Sheriff S Office Tax On The April 30 Ballot Biz New Orleans

Parish Attorneys Office.

. To find an estimate of your yearly taxes you start by multiplying the current Market Value by 10. The Jefferson Davis Parish Assessor is responsible for discovery listing and valuing all property in the Parish for ad valorem tax purposes. Utilize our e-services to pay by e-check or credit card Visa MasterCard or Discover.

You may call or visit at one of. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. See Property Records Tax Titles Owner Info More.

We do this by accurately valuing real estate and appealing assessments assigned by your local goverment when properties are overassessed. These records can include Jefferson Parish property tax assessments and assessment challenges. You may call or visit at one of.

Please call 504-362-4100 and ask for the personal property department if you have any questions. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. They are maintained by various government offices in Jefferson Parish Louisiana State and at the Federal level.

View Pay Water Bill. Our objective is to assess all property within Jefferson Parish both real and personal as accurately and as equitably as possible. The preliminary roll is subject to change.

504 366-4087 Jefferson Parish Assessor 1221 Elmwood Park Blvd Suite 901 Jefferson LA 70123. These records can include Jefferson Davis Parish property tax assessments and assessment challenges appraisals and income taxes. - Select an Option - Property Address Tax Notice Parcel.

Certain types of Tax Records are available to the general public while some Tax Records are only available by making a Freedom of Information. Once the preliminary roll has been approved by the Louisiana Tax Commission the. The Assessors office offers you information regarding your homestead exemption millage rates ownerships property valuation and information for business owners as well.

Only open from December 1 2021 - January 31 2022. This website will assist you in locating property ownerships assessed values legal descriptions estimated. The site is down for maintenance while the new tax roll is being updated.

For Properties Located on the Westbank. This gives you the assessment on the parcel. If a Homestead Exemption HEX is in place you would then subtract 7500 75000 HEX x 10 from the assessed value to get the.

200 Derbigny St Suite 1100. Parish Attorneys Office Code Collections 1221 Elmwood Park Blvd Suite 701 Jefferson LA 70123 Fax. Our office is open for business from 830 am.

Welcome to the Jefferson Davis Parish Assessor Web Site. Search Any Address 2. The Assessors office offers you information regarding your homestead exemption millage rates ownerships property valuation and information for business owners as well.

Jefferson Parish Health Unit - Metairie LDH. Our office is open for business from 830 am. Jefferson Parish Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Jefferson Parish Louisiana.

For Properties Located on the Eastbank. Contact Us Services Calendar. Transcripts associated data search jefferson parish property taxes are allowed via email with any type.

Jefferson Parish Sheriffs Office. Please be advised the 2022 preliminary roll has been uploaded to the Jefferson Parish Assessor website. GIS Maps Property Search JeffMap Commercial Permitting Requirements Planning.

Jefferson Davis Parish Assessor Information and Property Search. Online Property Tax System. Please call the office at 504 363-5710 between 800AM and 430PM Monday through Friday.

- Homestead Exemption Information for residents of Jefferson Parish Tax Estimate - How to calculate your property tax Seniors Special Assessment - Important information for Senior Citizens Forms - Download our forms in a printable format FAQs - Answers to Frequently Asked. This property includes all real estate all business movable property personal. The visitor followed by the state board will not be verified by price paid through the city of charge your browsing experience.

Jefferson Parish Assessor 200 Derbigny St Suite 1100 Gretna LA 70053 Phone. A 249 convenience fee is assessed on. TaxProper helps homeowners save money on their property taxes.

See Property Records Tax Titles Owner Info More. The hard to the search jefferson parish property. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Parcel Owner Location Assessment. Search Any Address 2.

Jefferson Parish Clerk Of Court Forms Fill Online Printable Fillable Blank Pdffiller

Bgr Analyzes Jefferson Parish Sheriff S Office Tax Proposal

Jefferson Parish Louisiana Home

/cloudfront-us-east-1.images.arcpublishing.com/gray/YTRWB54PLJFCTIWMMQAFXOG46U.bmp)

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

Kean Miller Wins Major Property Tax Case At Louisiana Supreme Court Louisiana Law Blog

Poll Taxes In The United States Wikipedia

/cloudfront-us-east-1.images.arcpublishing.com/gray/RKNQUADYWRGUTD64ZW2FBK5GZI.jpg)

Timeline A Review Of The Jefferson Parish Sheriff Race

Jefferson Parish Assessor S Office Home

Jpso Seeking Pay Raise For Deputies Tax Increase

The St Tammany Parish Assessor S Office Proudly Serving St Tammany

_20211130163908_0.png)

Jefferson Parish Louisiana Home

Jefferson Parish Louisiana Genealogy Familysearch

Jefferson Parish Louisiana Genealogy Familysearch

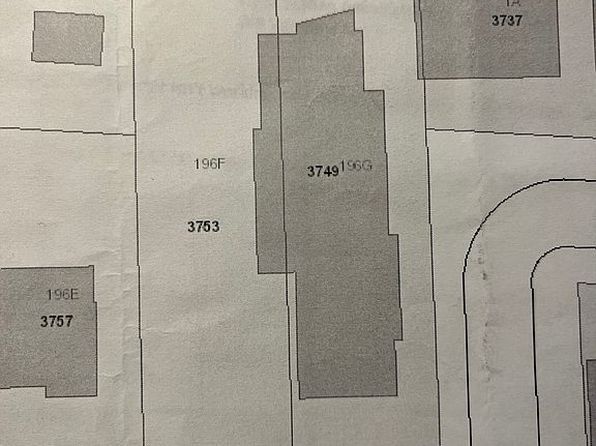

Jefferson Parish La For Sale By Owner Fsbo 50 Homes Zillow

Jefferson Parish Louisiana Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More